rewrite this content

Dear SaaStr: When Do VCs Try To Replace Founders as CEOs?

You’re worried about a bunch of VCs replacing you. That’s fair. You should be. It happens. Regularly — but not usually.

A few high-level things to think about.

- First, if you really screw up, shouldn’t you be replaced?

- Second, if you don’t end up being a great CEO in the long-run, shouldn’t you be replaced when someone can do the next stage materially better than you can? This will make you more money as a shareholder, no?

OK you probably agree with both in theory. But you’re really worried about the grey area in the middle. You give it 110%. For years. The company does reasonably well, or at least, doesn’t fail. You don’t think anyone could have done any better, or will do any better. But a bunch of guys want to replace you anyway.

That doesn’t often happen. But it does happen regularly, especially with bigger VC funds and when you’ve sold off a majority of the company.

So … how do you protect yourself?

Six tips:

- Don’t sell too much of the company. This is key tip #1. Roughly, you will give away control in proportion to the ownership stake you sell. If you only sell 20–30% of the company, because you don’t need that much capital … you’ll remain in de facto and legal control. If you sell 90%+, you won’t remain in control. Which is fair. It’s not your company anymore.

- Pick VCs on your board, especially early-stage VCs, that you trust. This is different than “nice”. This will go a long way. If you have options, if more than one VC wants to invest in you — do reference checks. For real. On the individual partner, not just the firm.

- Look at the track record of the Series A-B-C VCs you bring in. How often do they replace CEOs? It’s not necessarily truly a negative if they replace many CEOs, just understand what you are getting yourself in for.

- Be very transparent. Don’t hide stuff from your board. This >>spooks<< VCs. Every VC has lots of companies that unperform and even fail. But a surprise — that spooks people. Simple hack — send out a “flash report” the very first day of every month telling everyone how you did last month, the good and the less good.

- Be better than anyone else. Even if the company struggles, if the board doesn’t believe anyone else could do a better job, they won’t replace the CEO, 9/10. Sometimes, it’s just a B+ idea and/or a B- market.

- Don’t expect — or ask for — another check. This is key tip #2. The most common reason CEOs get fired is a third check. An unexpected check. VCs having to write another check into a company they don’t want to write another check into. This creates huge stress at the partnership level for VCs. They don’t want to write another check into their struggling companies. If you don’t ask for anymore money — the CEO’s job is a lot safer.

Do those 6 things and your odds of ever being “fired” or replaced as CEO without your consent are very low.

Bear in mind, these days, almost no “West Coast” style VC firm actually wants to replace the CEO. They usually only push when they feel they have no choice, and when there’s a lot of money already into the company. But it’s sort of a close-to-last resort in many cases.

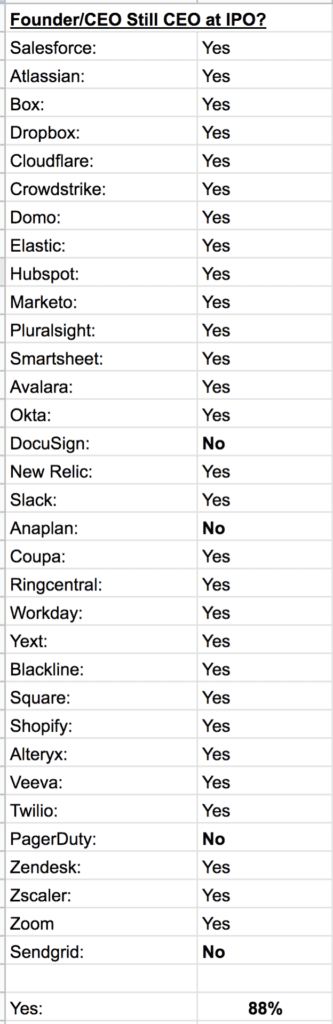

After all, 90% of SaaS public companies go public … with the founder CEO as CEO:

More here: 5 Things To Be Wary of In VC Financings

Leave a Reply